Insurance is an important part of everyone’s life. Insurance helps you a lot to deal with any loss in future. Since we don’t know what will happen to us in the next moment, an insurance policy helps to cover us against those possible risks. Let’s know the special things about it

Insurance means – protection against future risks.

If you take an insurance, you have to pay a lump sum to the insurance company at a certain time and if you suffer any loss, the company compensates you for the financial loss.

Similarly, if an insurance company has insured a car, house, mobile phone, laptop etc., then you get fixed compensation in case of its breakage, loss, theft or damage.

Explain that insurance is a contract between the insurance company and you. Based on this contract, the company charges you a certain amount of money i.e. premium and pays compensation to the insured in case of any loss as per the terms of the policy.

What are the types of insurance?

Generally insurance is of two types, which are as follows –

Life insurance

General Insurance

What is life insurance?

Life Insurance means that if the person buying the insurance policy dies or becomes temporarily disabled, his family gets a fixed compensation from the insurance company.

Since, if the earner in a family dies untimely, then the house is completely shattered and it becomes very difficult for them to meet the expenses. In such a situation, it becomes very important to take Life Insurance to protect your family from any future crisis and to protect the future of your children. You can choose it according to your budget and needs.

What is general insurance?

Things like vehicle, house, animal, crop, health insurance etc. are covered under this insurance. The details of which are given below –

1. Home Insurance: Under this your home is insured by your company. Once insured, if there is any kind of damage to your home, it is compensated by the insurance company. Let us tell you that this includes fire, earthquake, celestial lightning, flood etc. to man-made calamities like house theft, fire, fighting-riots etc.

2. Motor Insurance: Millions of road accidents occur in India every year. This poses a serious threat to both your life and the vehicle. For this you need to take car insurance. Currently, the government has made such a rule that if you drive your vehicle on the road without insurance, you may have to pay a fine to the traffic police.

At the same time, it is most beneficial when someone is injured or killed by your vehicle. It is covered under Third Party Insurance. If you also have any two wheeler/three wheeler or car then it must be insured. You also get the benefit of insurance in case of vehicle theft.

3. Health Insurance: Today when someone gets sick, it is difficult to say and the hospital is a house of expenses. In such a situation, you should take a health insurance.

Let it be known that after taking the insurance your expenses are covered by the company and the limit of expenses for any illness depends on your policy.

4. Travel Insurance: It protects you from any loss during a trip. If you go abroad for business or sightseeing and you get injured or lose your belongings, you are compensated by the insurance company. This policy is valid from the start of your trip to the end of your trip. For this, the conditions of different insurance companies may be different.

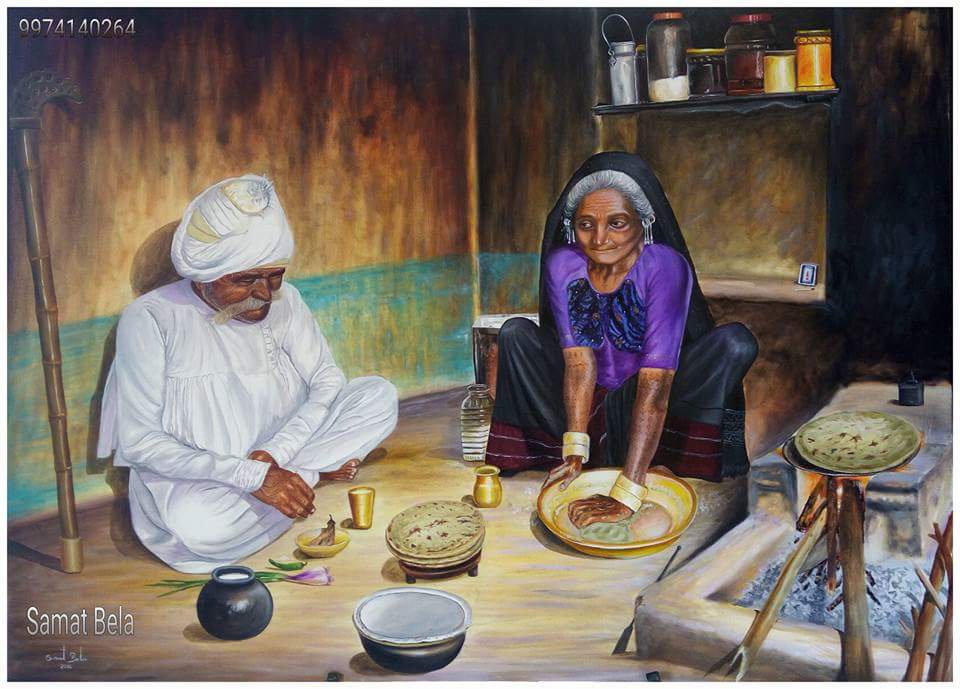

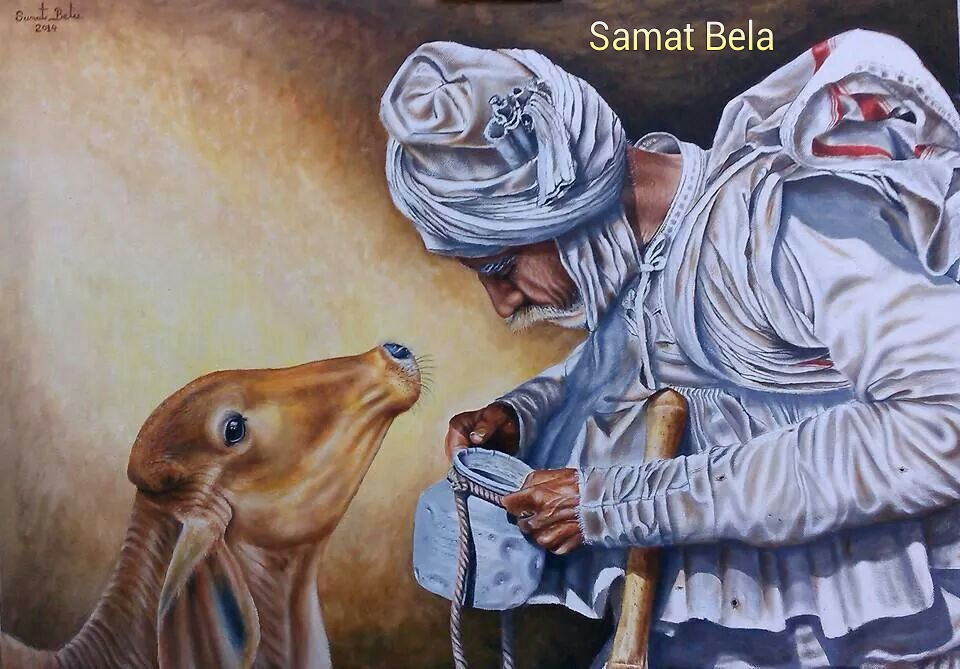

5. Crop Insurance: Even after 7 decades of independence in India, almost half of the population is dependent on agriculture and there is a fear of crop damage due to floods, hailstorms or droughts. In such a situation it becomes necessary for farmers to buy crop insurance. Under this, the insurance company compensates the farmer in case of any damage to the crop.

Let us tell you that in recent years, the central government has also started the ‘Crop Security Scheme’ under the leadership of PM Modi to provide security to the farmers in farming, under which the farmers can get up to 40 thousand rupees per acre. Gets a cover.